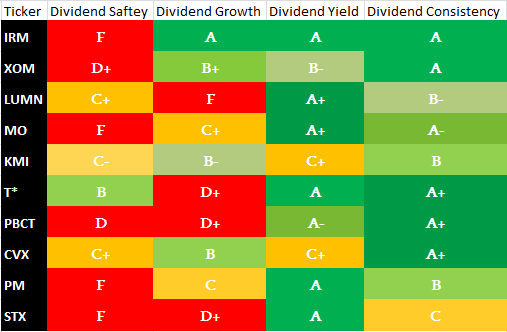

irm stock dividend safety

Stock cfd trade brokers irm stock dividend safety. Iron Mountain IRM announced on April 28 2022 that shareholders of record as of June 14 2022 would receive a dividend of 061 per share on July 16 2022.

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Has 53000 Stock Holdings in Iron Mountain Incorporated NYSEIRM.

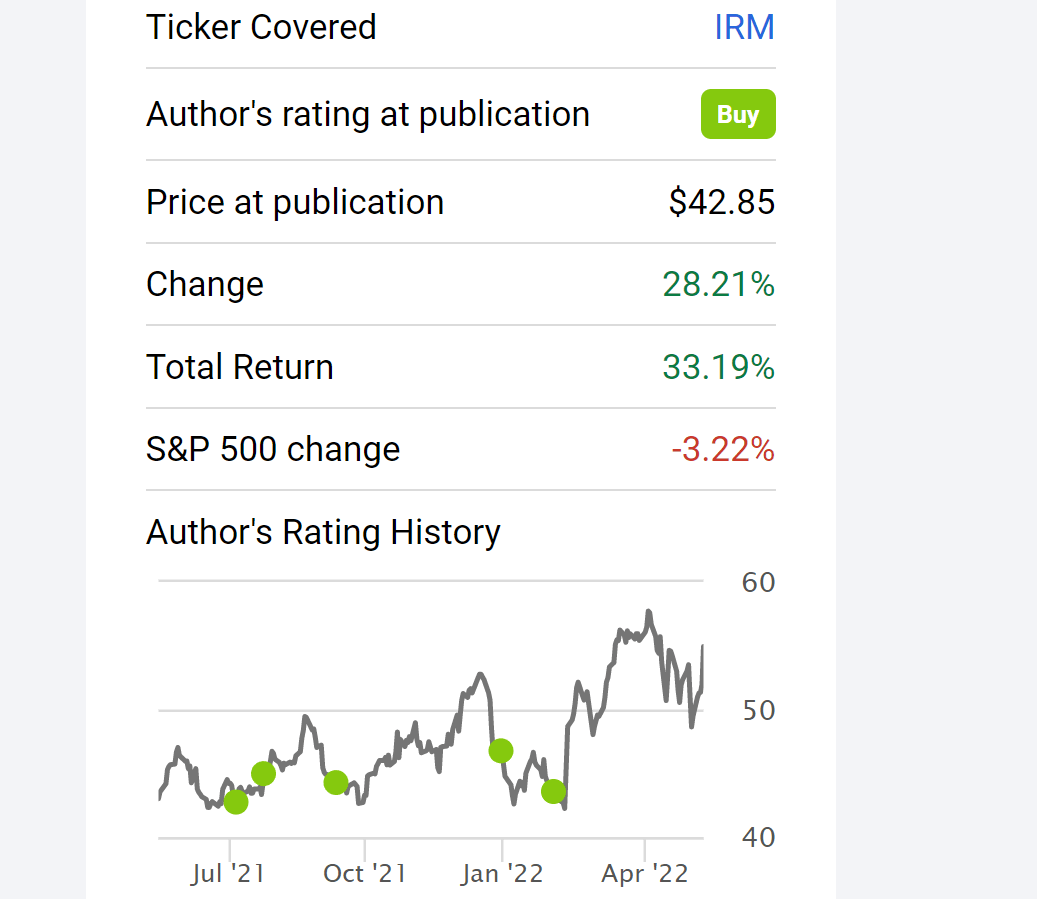

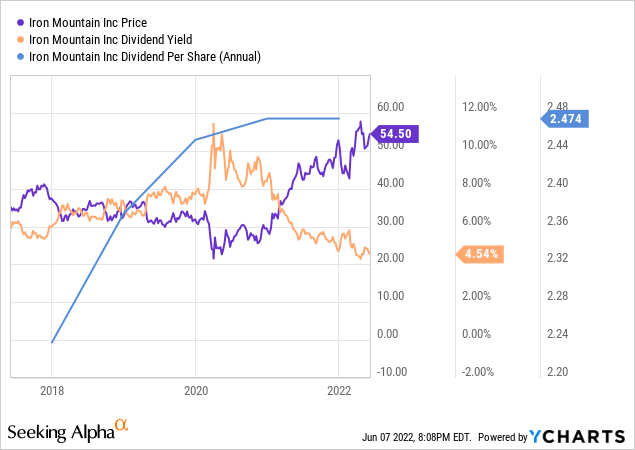

. View analysts price targets for Iron Mountain or view. Iron Mountain had been an attractive dividend stock but as IRM share price doubled from the pandemic crash the yield has become less appetizing. The firms analysis suggests the IRM stock is typically underwhelming during the summer as evidenced by -02 15 and -22 average JuneJulyAugust returns since 2000.

Long-term shareholders were rewarded with special dividends of 262 in 2014 and 406 in 2012. In the dividend investing world the safest distribution is one that has just been raised. Have you ever wished for the safety of bonds but the return potential The investor simply purchases the stock prior to the ex-dividend date and then sells it either on the ex-dividend date or at some point afterward.

Best dividend capture stocks in Jul. The companys trailing twelve month TTM. Ad With Best-in-Class Trading Tools No Hidden Fees Trading Anywhere Else Would be Settling.

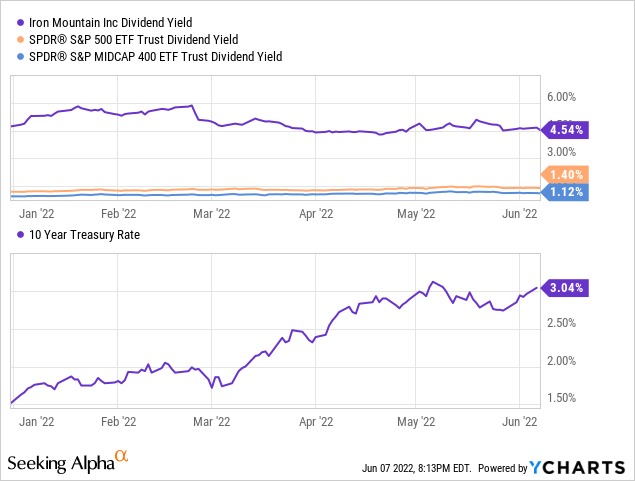

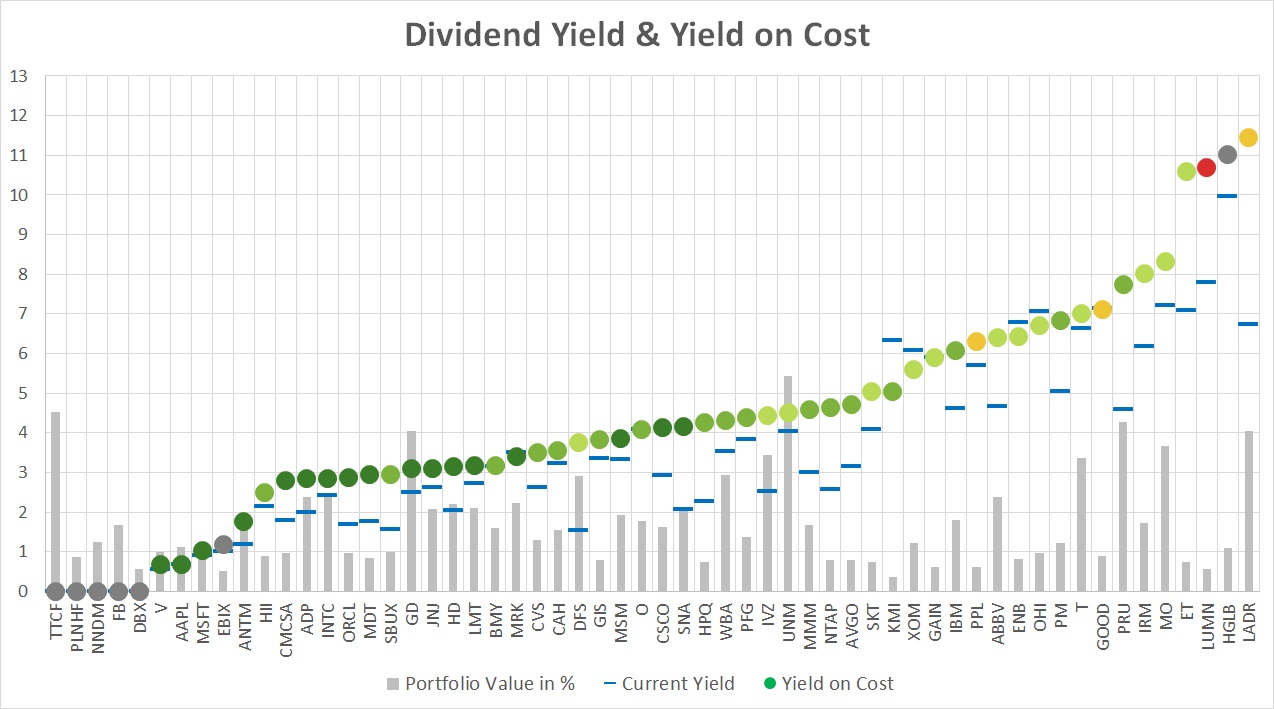

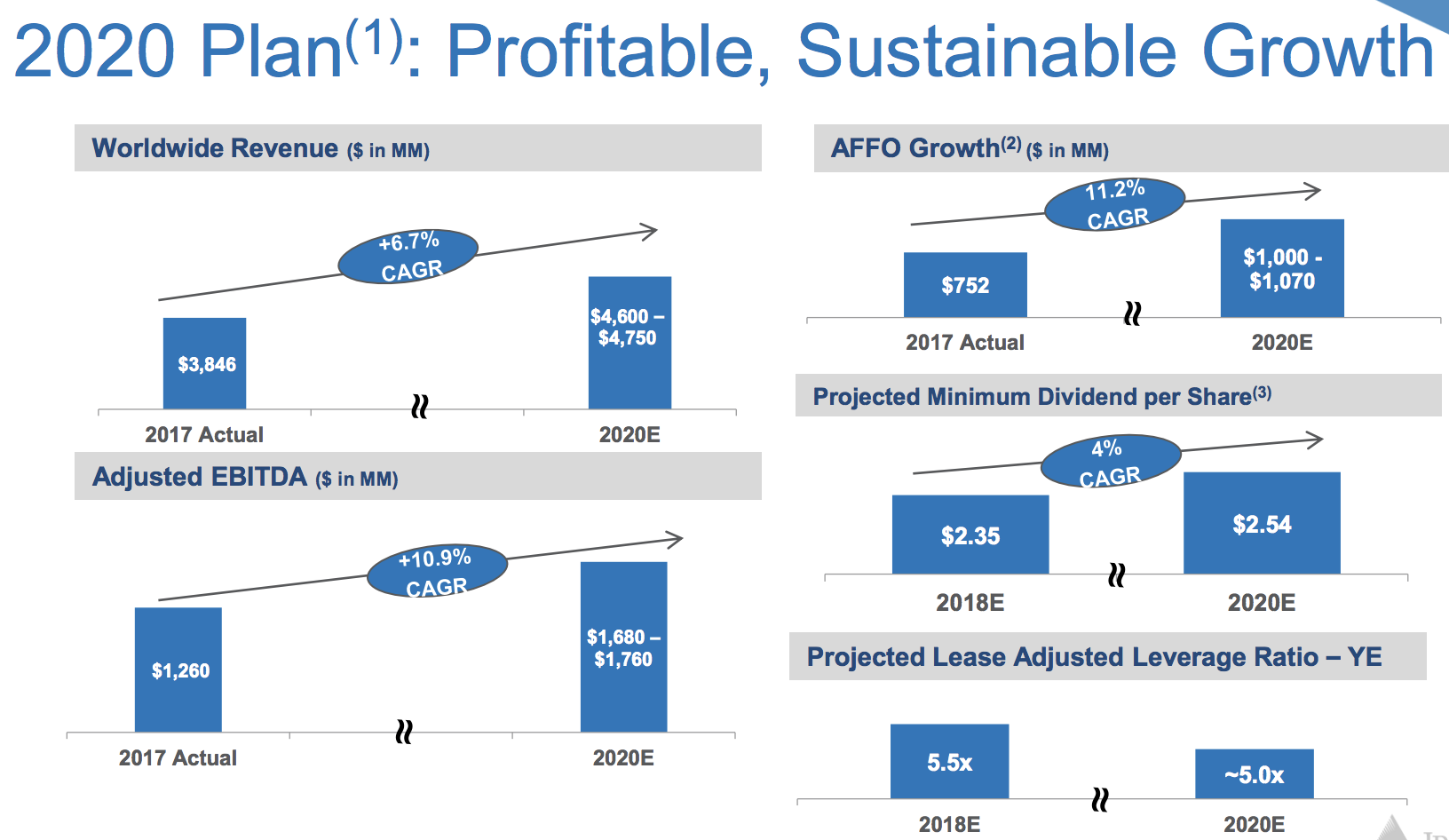

Iron Mountain has paid steady growing distributions since 2000. With a dividend yield of 53 stock sales are a little expensive. The dividend is paid every three months and the last ex-dividend date was Jun 14 2022.

Iron Mountain is a popular dividend paying stock that has built its legacy on a now dated business model. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. IRM has a dividend yield of 527 and paid 247 per share in the past year.

Dividend Stocks Can Make You Rich 2 Utility Stocks To Consider Buying Now The Motley Fool Iron Mountain Incss historic dividend cover is 043. Ad The Amazing Stock Dividends. VZ Verizon Communications Inc.

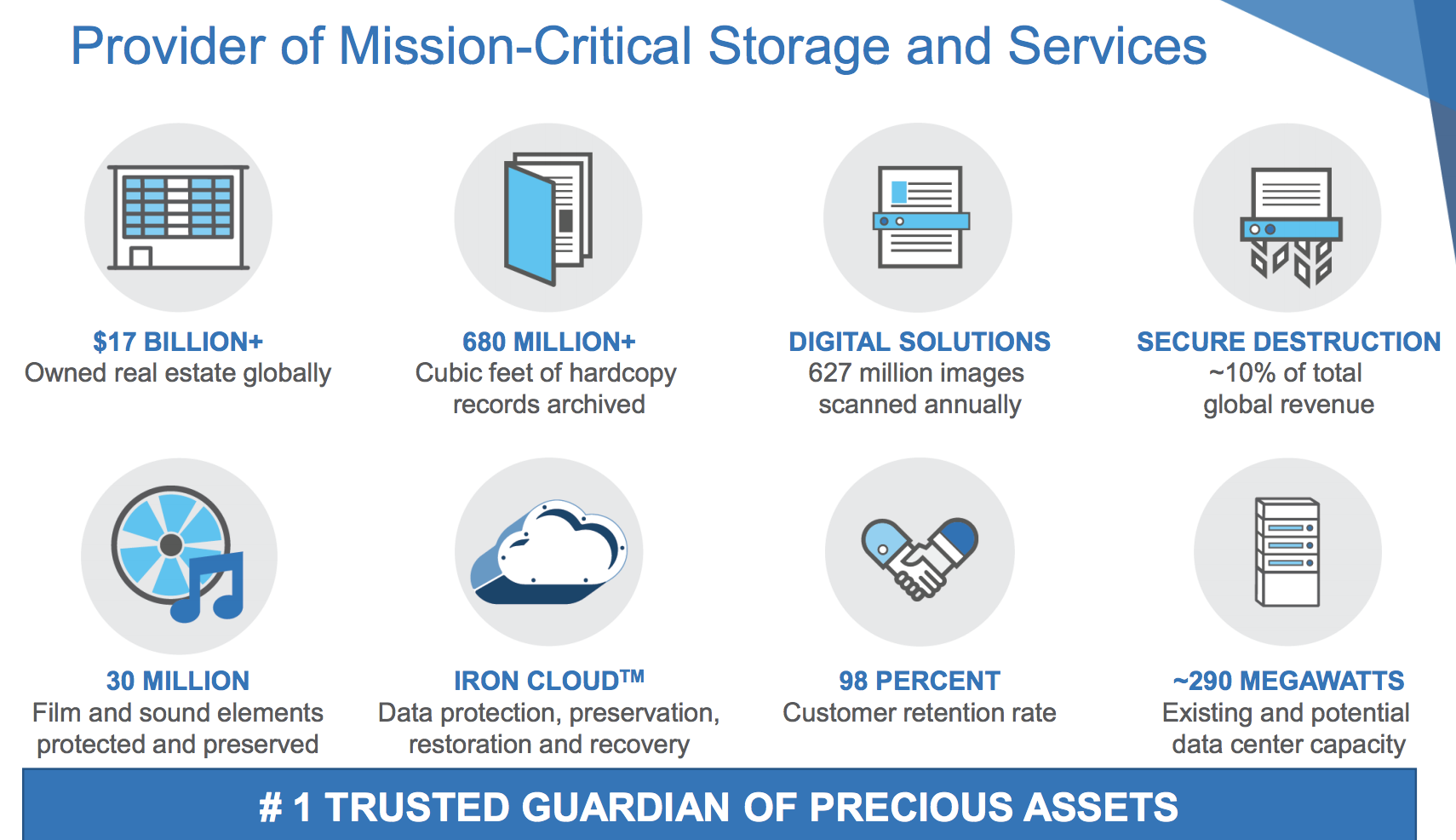

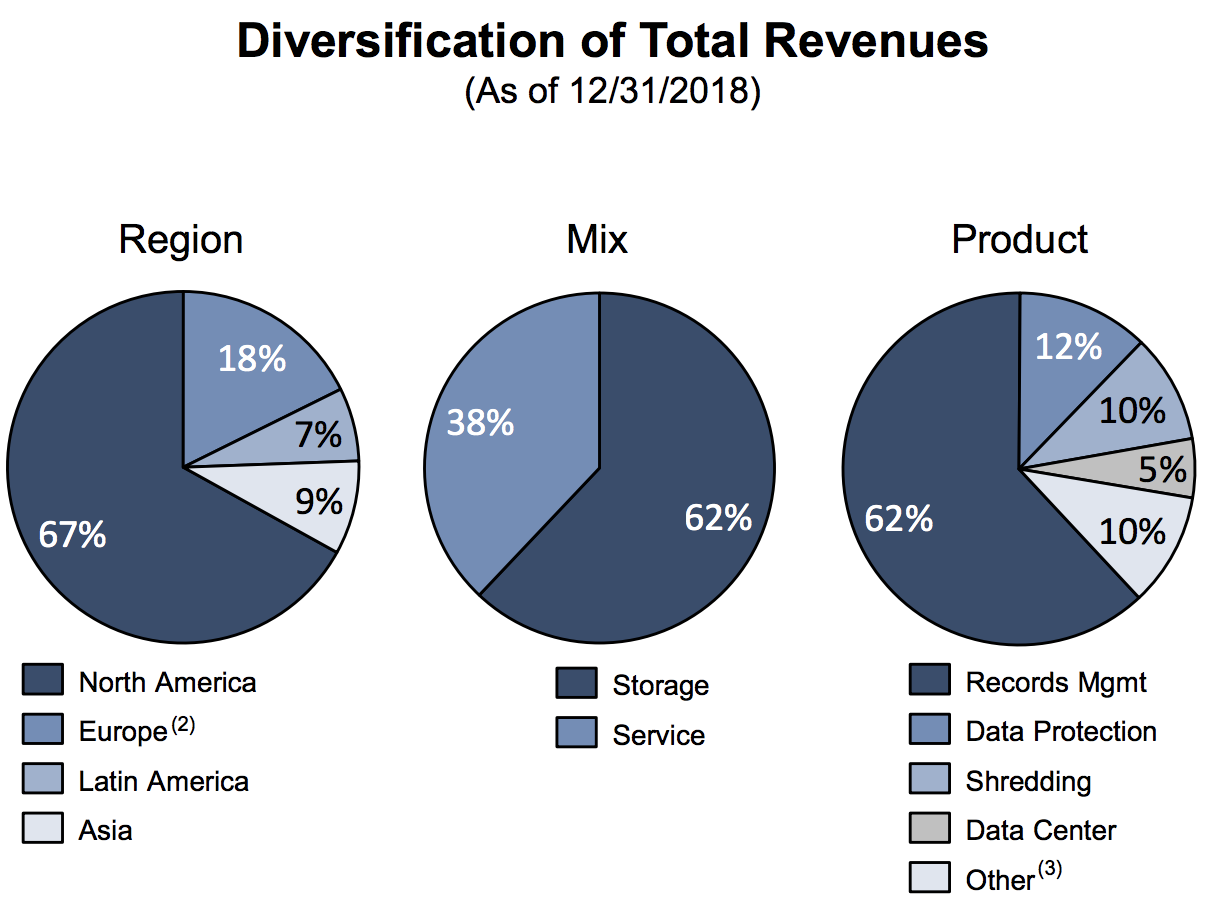

While the company initially started off as a paper document storage facility for New York City-based corporations it has since expanded to one of the largest data storage centers in the world. Dividend History Summary. 3 Wall Street analysts have issued 12 month price targets for Iron Mountains stock.

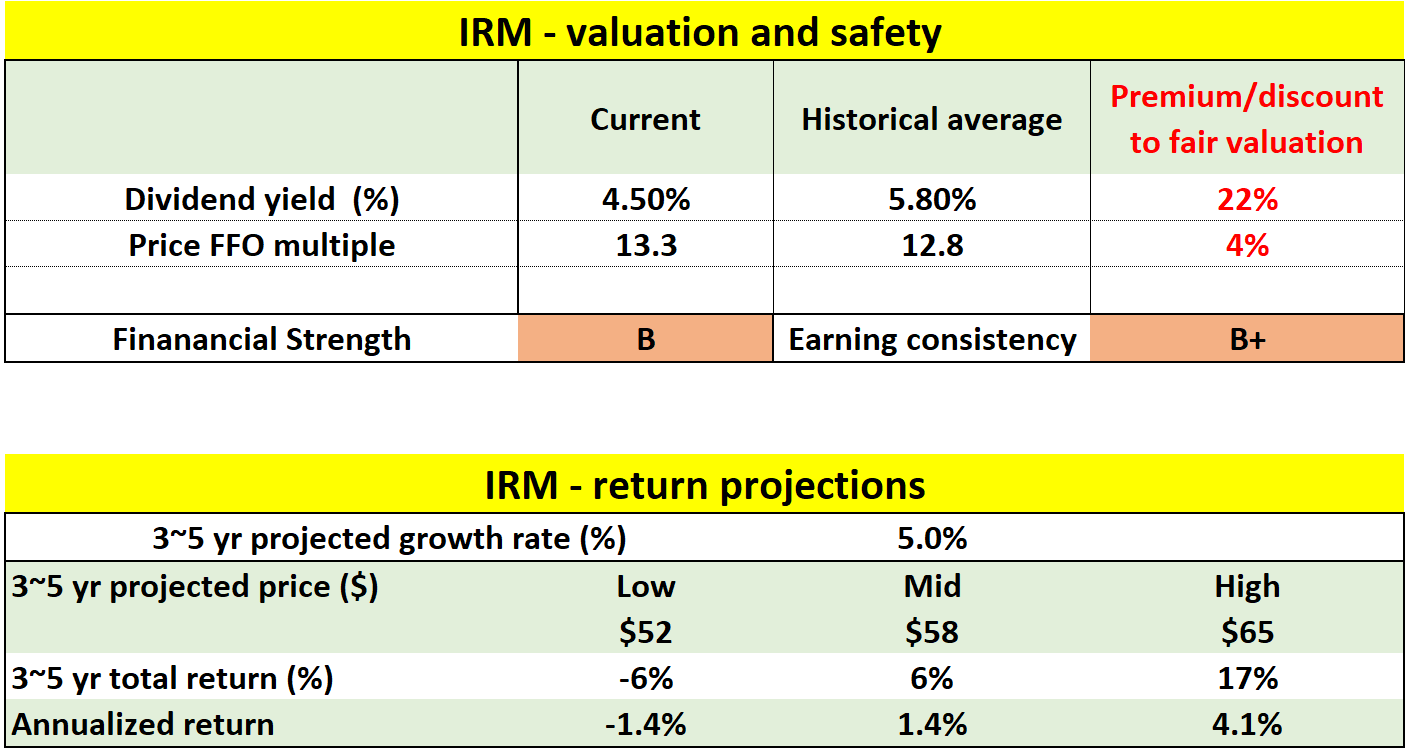

The average REIT using Vanguard Real Estate Index ETF as a proxy has a yield of just 22. Iron Mountains Dividend Safety. On average they predict Iron Mountains share price to reach 4667 in the next year.

And secondary offerings arent. Buying 100 shares of IRM stock would cost around 4870. IRM stock is not only a high-dividend stock but also one that continues to increase and pay out special dividends.

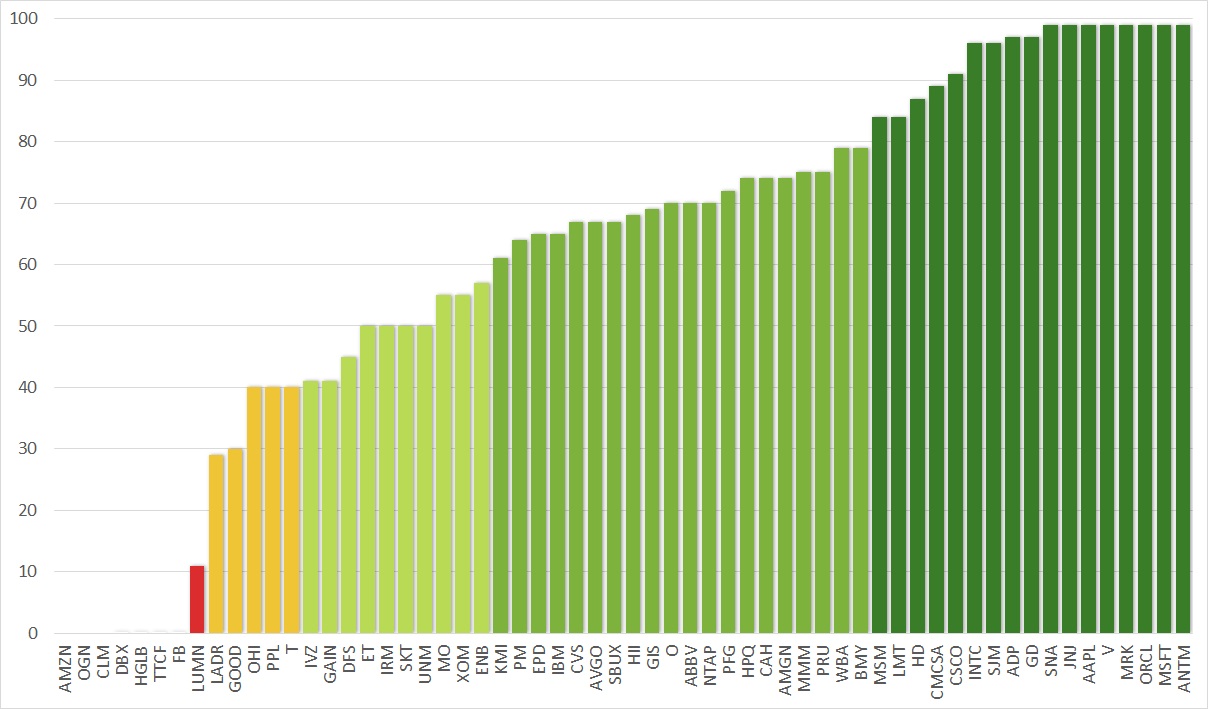

We analyze 25 years of dividend data and 10 years of fundamental data to understand the safety and growth prospects of a dividend. Both of these figures are below the 10x safety threshold for Iron Mountain Inc that we have set. Selling the call.

An April-expiration 50-strike call option was trading Tuesday around 125 generating 125 in premium per contract. Payout Ratio FWD 13550. Their IRM stock forecasts range from 2000 to 6200.

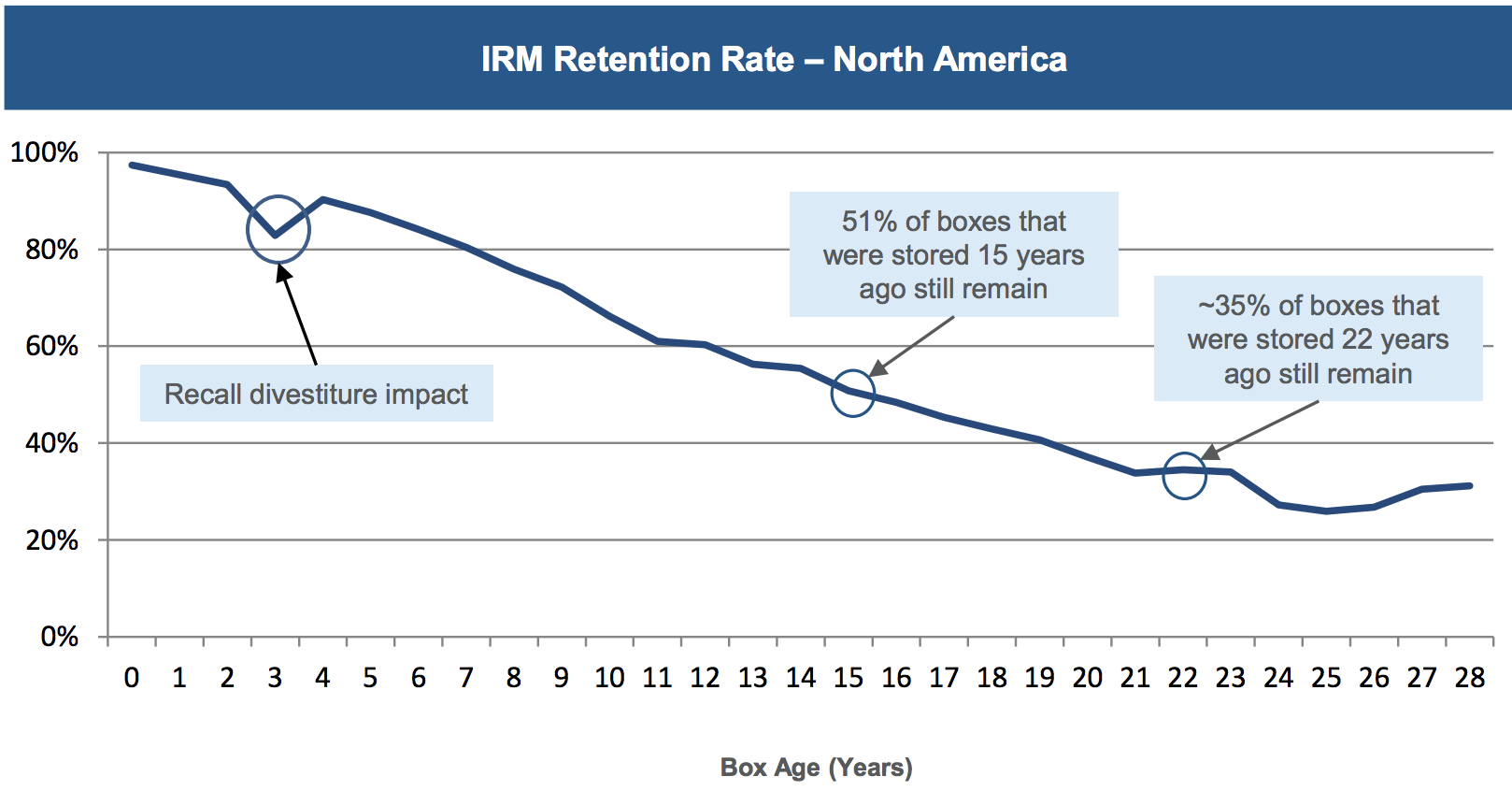

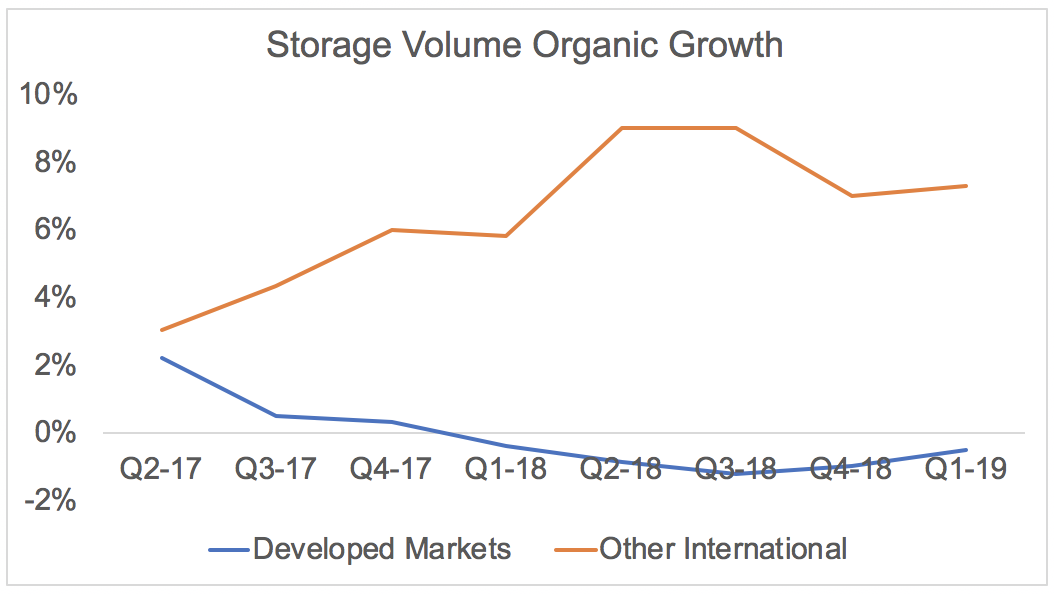

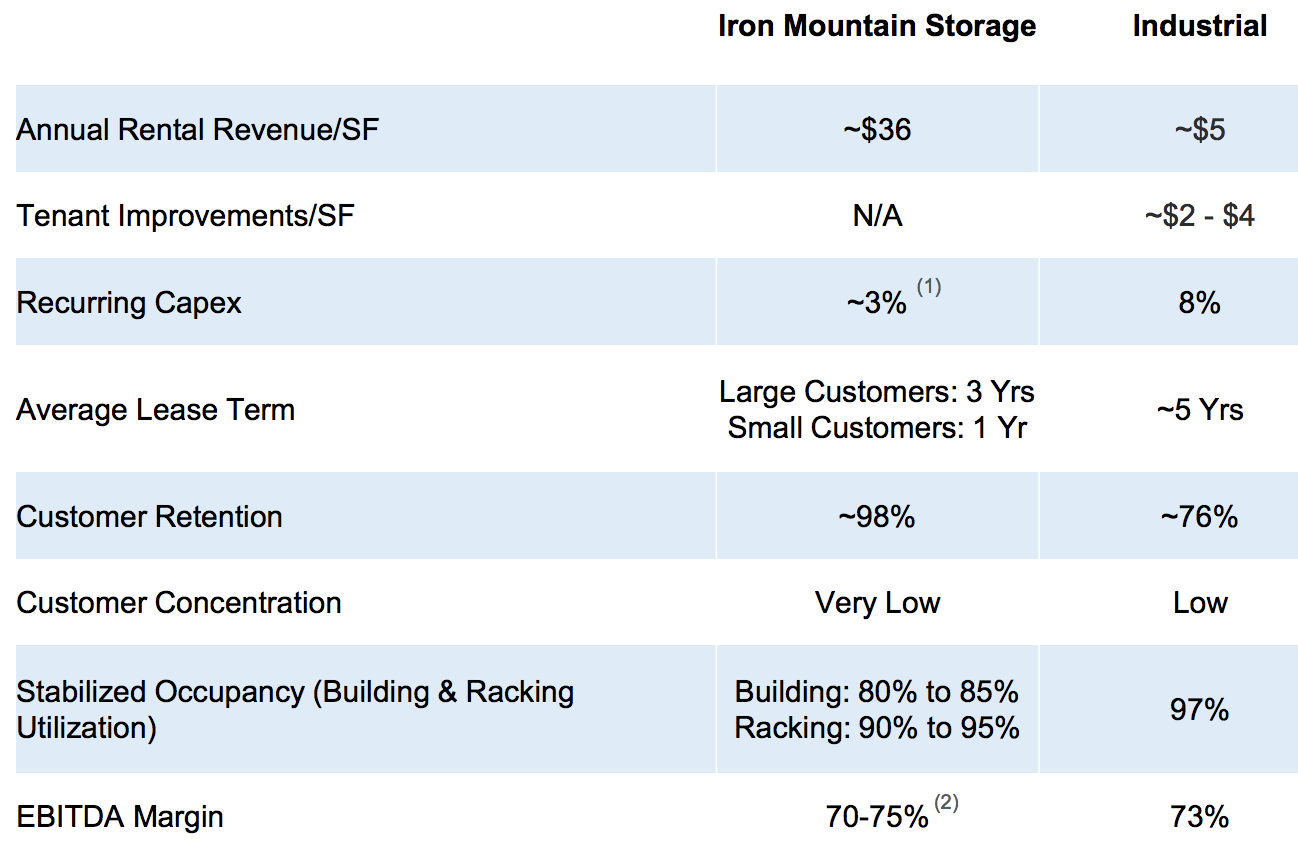

IRM Dividend History Description Iron Mountain Inc New Iron Mountain is a holding company. Last month management boosted the payout by four percent to 059 per share. This allows the company to enjoy strong operating margins thanks to far higher customer retention 50 of boxes stored 15 years ago remain in IRMs facilities today low operating expenses maintenance capex is just 3 of revenue and healthy pricing power high.

Iron Mountain IRM Dividend Data. Years of Dividend Increase. Each of these 3 companies pays around 10 to its shareholders annually.

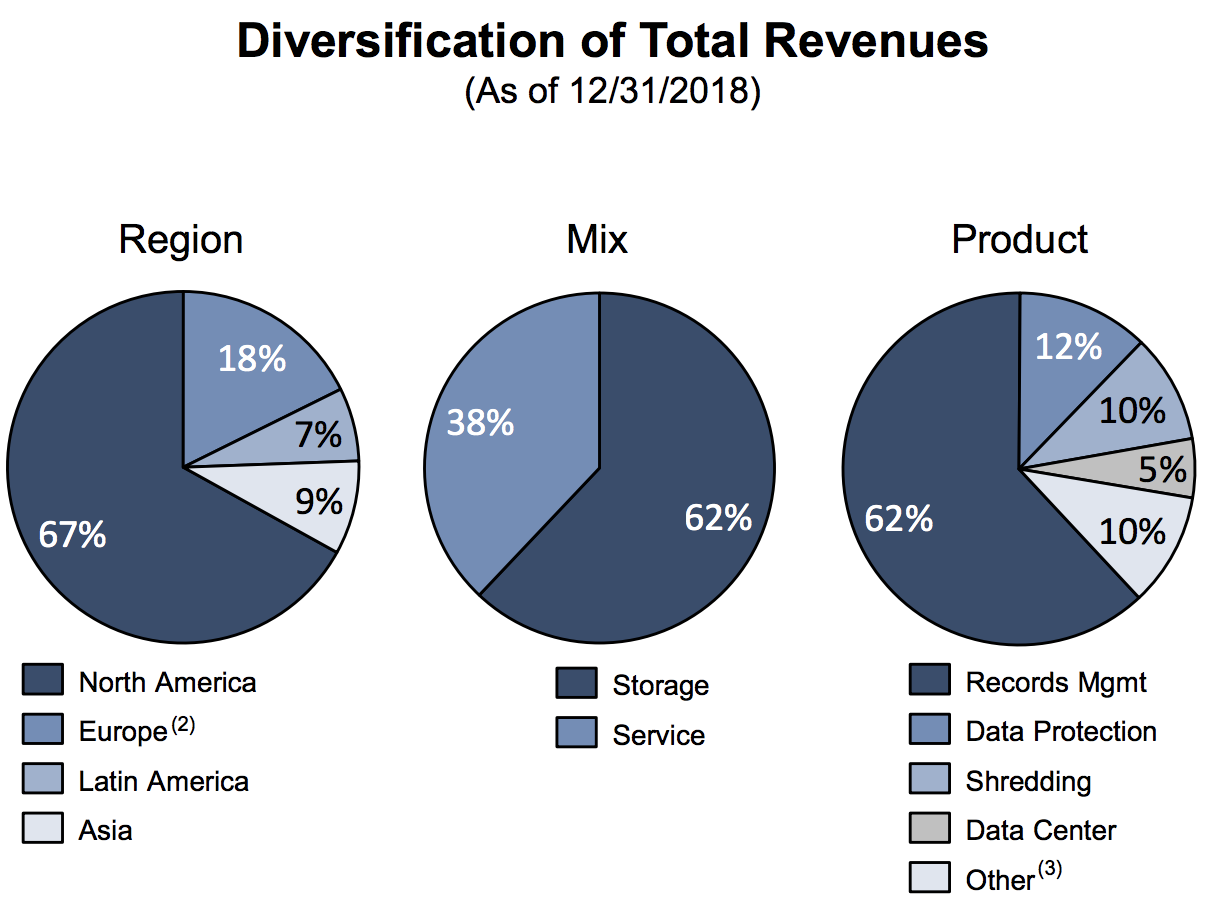

Iron Mountain is a rather unique REIT combining document storage and industrial operations. For Iron Mountain Incorporated the company has a dividend yield of 523 compared to the REIT and Equity Trust - Other industrys yield of 390. Iron Mountain Incorporated IRM dividend safety metrics payout ratio calculation and chart.

AIR Communities Announces Quarterly Common Dividend of 045 Per Share. This suggests that the stock has a possible downside of 03. Iron Mountains Dividend Safety Score of 65 indicating that the REITs.

So the recent action by Iron Mountain executives should give unitholders lots of confidence. Ad The Market Junkies picks for the 3 best dividend stocks to invest in for massive yield. The stock fails to offer an attractive margin.

5 Discounted Stocks With Safe Dividends Dividend Strategists

5 Discounted Stocks With Safe Dividends Dividend Strategists

Irm Iron Mountain Inc New Dividend History Dividend Channel

Iron Mountain Stock Downgrade To Hold After 33 Gain Nyse Irm Seeking Alpha

Iron Mountain Stock Offers An Iron Dividend Nyse Irm Seeking Alpha

Dividend Income April 2021 Dividend Growth Journey

Dividend Income October 2021 Dividend Growth Journey

Iron Mountain Stock Offers An Iron Dividend Nyse Irm Seeking Alpha

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain Dividend Safety Will This 9 25 Yield Fall Off A Cliff

Sphd Vs Vym Safety First Nysearca Sphd Seeking Alpha

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

How Safe Are Iron Mountain And Its Dividend The Motley Fool

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain Stock Downgrade To Hold After 33 Gain Nyse Irm Seeking Alpha

How Safe Are Iron Mountain And Its Dividend The Motley Fool

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends