bexar county tax assessor payment

After locating the account you can pay online by credit card or eCheck. To pay your property taxes in San Antonio you can go to the Bexar County Tax Office website and pay online by mail or in person.

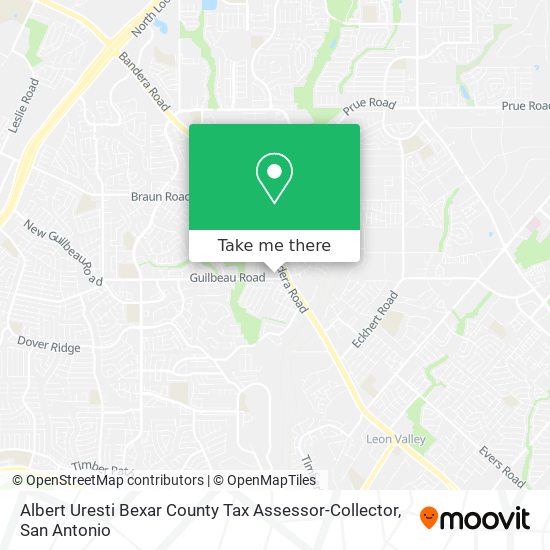

How To Get To Albert Uresti Bexar County Tax Assessor Collector In San Antonio By Bus

Clicking on the link below will take you to to a webpage with specific information and instructions for.

. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. Bexar County Tax Assessor-Collector Albert Uresti Bexar County TX. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers.

Northwest - 8407 Bandera Rd. Bexar County Tax Assessor-Collector Office P. Web Bexar County Tax Assessor-Collector Albert Uresti Bexar County TX - Official Website.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. 100 Dolorosa San Antonio TX. The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH.

Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. This service includes filing an exemption on your residential. Payment BAC TAX SERVICES CORPORATION 2004-11-30 2004 Payment FIRST AMERICAN TITLE INS.

Northeast - 3370 Nacogdoches Rd. The Pre-Payment Plan allows Homeowners and Business Owners without a mortgage escrow account to pre-pay their taxes in monthly installments through September 15. The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically.

As a property owner your most. You can search for any account whose property taxes are collected by the Bexar County Tax Office. You can search for any account whose property taxes are collected by the Bexar County Tax Office.

After locating the account you can pay online by credit card or eCheck. Please follow the instructions below. Other locations may be available.

Please follow the instructions below. Pecos La Trinidad Southside - 3505 Pleasanton Rd. Property Tax Overpayments Search for any.

The address for the Tax Office is. As a property owner your most. Bexar County Payment Locations Downtown - 233 N.

Box 839950 San Antonio TX 78283-3950 Please allow up to 15 days for the processing of your new window sticker or new plates by. Enter an account number owners name last. The district appraises property according to the Texas Property Tax Code.

2-Payments per year. Please select the type of payment you are interested in making from the options below. Acceptable forms of payment vary by county.

4th payment due on or before July 31st 10-Month Payment Plan The Bexar County Tax Assessor-Collectors Office is the only County in the State of Texas with a 10-month payment plan. Please contact your county tax office or visit their Web site to find the office closest to you. MARCH 31 2023- Last day to pay 2022 business personal property taxes without accruing attorney fees.

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

Tax Assessor Collectors Association Of Texas

Tax Workshop On Protesting San Antonio Property Appraisals

Chief Appraiser Expects A New Record Of Appeals To Be Filed Next Week In Bexar County

Uresti Reminds Taxpayers Wanting To Participate In The 2021 Half Payment Plan That The First Half Payment Is Due By Tuesday November 30th La Prensa Texas

Bexar County Tax Assessor Collector 18 Reviews 7663 Guilbeau Rd San Antonio Tx Yelp

Bexar Co Expanding Resources For Residents

Bexar County Homeowners Behind On Tax Payments Have Access To 80m Aid

Texas Property Tax Sales In A Hybrid Tax Deed State Ted Thomas

Latest Property Tax Sales In Texas Mvba

Homeowner Relief Program Offers Up To 25 000 For Property Taxes 40 000 For Mortgages Woai

Bexar County Tax Assessor Collector 18 Reviews 7663 Guilbeau Rd San Antonio Tx Yelp

Everything You Need To Know About Bexar County Property Tax

Once Quiet Race For Tax Assessor Gets A Lot Louder

Homeowners A Tax Payment Deadline For The Half Payment Plan Is Coming Up In Bexar County

Fill Free Fillable Bexar Appraisal District Pdf Forms

The Rim Avoids Foreclosure With 1 Million Tax Check Tpr